Private crypto

KKR, Apollo, Hamilton Lane and Partners Group are among those seeking to raise money through ‘tokenised’ funds

It is no surprise that crypto has been making waves in various industries around the world. Even manufacturers and retailers are now implementing crypto as it gains popularity. Companies like Visa, Paypal, Google, and Tesla have all admitted to owning or developing crypto for their companies. Cryptocom private jet Asked specifically whether Jetnet would make the website exclusive to subscribers, or whether it would begin blocking the tracking numbers of private aircraft on request, Swaim says no. But users are far from convinced. “PE’s don’t just hand out $20 million checks out of charity. They usually want a return,” one user wrote.

Cryptocom private

If you’re buying and holding crypto for a longer time, you’re better off using a non-custodial wallet, a.k.a an offline “cold” wallet. This way, you hold the keys yourself, so you’ll always have control over your crypto and access to your own funds. The most basic way of doing this would be to have a paper wallet – where you write down the keys on a piece of paper, laminate it, and guard it with your life. Crypto.com Rewards Visa Card vs. SoFi Credit Card Your Review *The Gennaro and Goldfeder MPC Algorithm

The company launched in 2007 and has since won travel and tourism industry awards, including a listing as one of Smarta’s Top 100 Small Businesses for 2010 and Best Business Award for “Best Innovation” at the same time, and Flight Global’s Site of the Year Webbies award. It maintains profiles on all major social networks and holds regular online promotions. Crypto.com Card Review – Fees, Earn, Tiers, Perks In March 2014, the IRS declared that “virtual currency,” such as Bitcoin and other cryptocurrency, will be taxed by the IRS as “property” and not currency. See IRS Notice 2014-21, Guidance on Virtual Currency (March 25, 2014). Consequently, every individual or business that owns cryptocurrency will generally need to, among other things, (i) keep detailed records of cryptocurrency purchases and sales, (ii) pay taxes on any gains that may have been made upon the sale of cryptocurrency for cash, (iii) pay taxes on any gains that may have been made upon the purchase of a good or service with cryptocurrency, and (iv) pay taxes on the fair market value of any mined cryptocurrency, as of the date of receipt.

Crypto com private jet partnership

The opinions expressed in this article are solely those of the author. Prince of Travel does not give investment advice and is not responsible for any losses you may incur. Always do your own research and invest at your own risk. Crypto.com Value Proposition The average global consumer does not make the same distinction between private cryptocurrency and CBDCs as policymakers and crypto creators do. In fact, the relationship between their perceptions of the macroeconomic risks of private cryptocurrency and their support for CBDCs runs counter to what many policymakers and crypto advocates might expect. Namely, people who said decentralized cryptocurrency is a danger to financial stability were also much more likely to say they oppose their country issuing a CBDC, and people who think cryptocurrency is good for financial stability are more likely to support CBDCs.- Best crypto to buy

- Treasury says it tied btc transactions

- How to withdraw money from cryptocom

- Btc max supply

- Buy bitcoin online

- Bitcoin crash prediction

- Crypto fees

- Btcto usd

- 1 btc in usd

- Cryptocom dogecoin

- Cryptocom verification process

- Crypto punk

- What is cryptocurrency mining

- How much to buy dogecoin

- How to make a crypto wallet

- Will dogecoin be on coinbase

- What is joe crypto

- Buy crypto with credit card

- Cryptocurrency bitcoin price

- How to transfer money from cryptocom to bank account

- How is crypto taxed

- Gas fees eth

- New crypto to buy

- Cryptocom login

- Dogecoin white paper

- Cryptocom desktop

- Polygon crypto

- Top 20 cryptocurrency

- How to buy on cryptocom

- When to buy bitcoin

- What is bitcoin sv

- Ethusd converter

- Apps cryptocurrency

- Free ethereum

- Bitcoin vault

- Crypto pc

- Borrow against crypto

- Staking ethereum

- Bitcoin cryptocurrency

- Defi ethereum wall

- Cryptocurrency wallet website

- Safemoon crypto price

- How to transfer crypto to bank account

- Crypto com limit order

- How does btc mining work

- Pulse x crypto price

- Cryptocom customer service

- Btc price converter

- Bitgert

- Wifedoge crypto price

- Crypto credit

- Buy crypto card

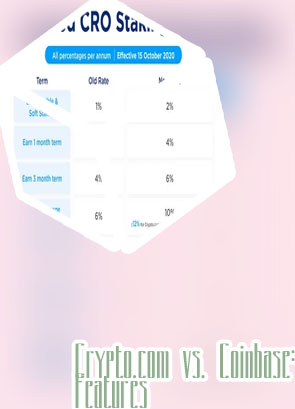

- Crypto earn

- Crypto com referral

- Btc creator

- Google bitcoin

- Cryptocurrency exchanges

- Ethusd price

- All crypto coins

- Full send crypto price